Market Trends of Agricultural Biologicals Testing Industry

This section covers the major market trends shaping the Agricultural Biologicals Testing Market according to our research experts:

Government Regulations Favoring Agricultural Biologicals are Driving the Market

Given that biopesticides tend to pose fewer environmental risks compared to chemical pesticides, the United States Environmental Protection Agency (USEPA) generally requires less stringent data to register a biopesticide than to register a chemical pesticide. As a result, new biopesticides are often registered in less than a year, compared to an average of more than three years for chemical pesticides.

Biopesticides are regulated in the European Union in the same manner as chemical pesticides. The Organization for Economic Co-operation and Development (OECD), a 34-country group headquartered in Paris, France, assists EU governments in a quick and thorough assessment of biopesticide for eliminating risks to humans and the environment.

In the United States, the registration process for biofertilizers is done at the state level and they are registered under soil amendments, as they contain organic components. In Canada, the Canadian Food Inspection Agency (CFIA) has well-defined processes accepted by the industry, for the registration of biofertilizers. This practice allows biofertilizer companies to operate in a safe environment and attract new investors for the biofertilizer industry. Thus the favorable regulatory structure related to the use of biopesticides is giving a boost to the agricultural biologicals market in general and the biopesticide market.

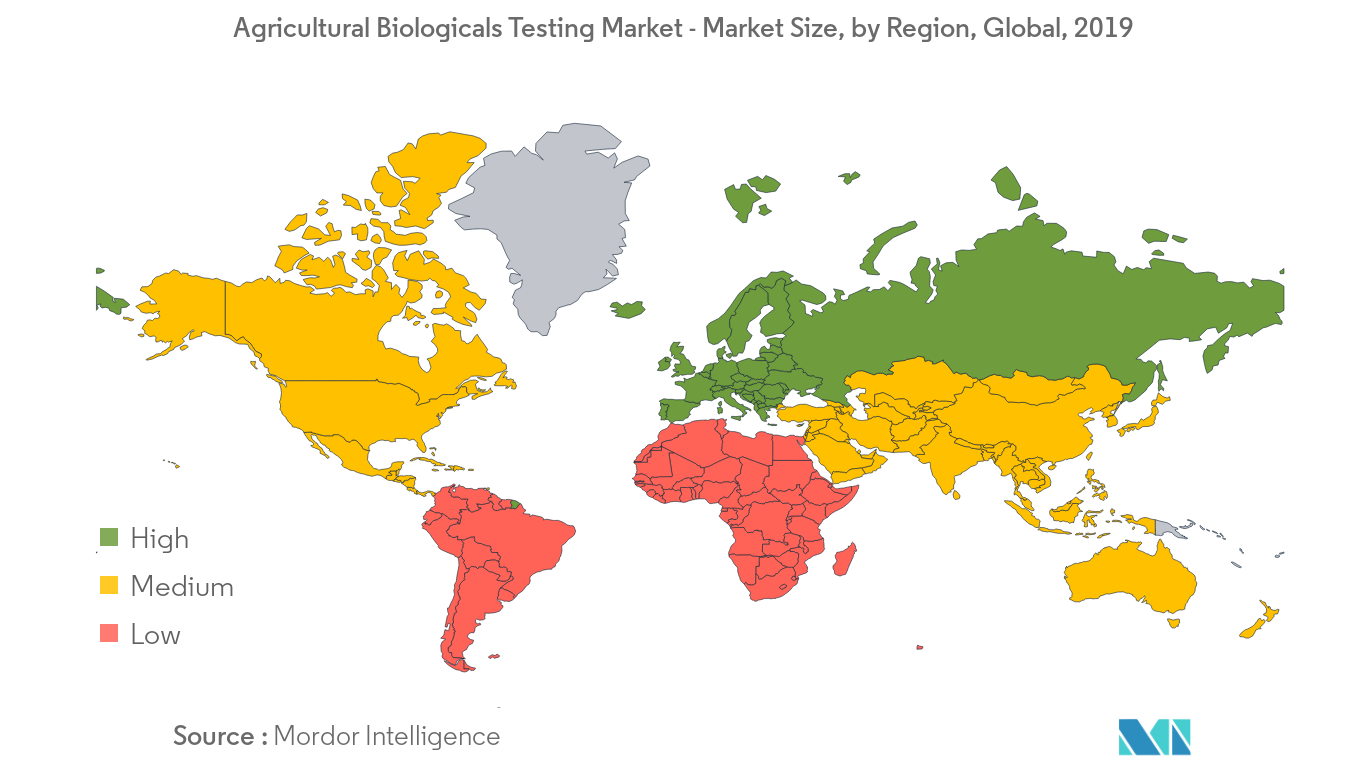

Europe is the Largest Market as of 2019

The European agricultural biologicals testing market is driven by the increasing usage of biological agricultural products such as biostimulants and biofertilizers in the region. The stringent regulations imposed on chemical agrochemicals in various countries of this region have encouraged consumers to shift from the traditional pesticides to less toxic biological products. The agro biologicals market is also gaining momentum with the entry of major players like Bayer Cropscience and Marrone Bio Innovations Inc. into the market.

Italy, Germany, and the United Kingdom are some leading countries in the European market. The developments in the agricultural biologicals market are further stimulating the growth of the testing market for these products in Europe who are promoting their products and services including field trials, product analysis, and regulatory compliance. Owing to the above-stated factors, the agricultural biologicals market in Europe is also projected to witness significant growth over the coming years.