Food Packaging Testing Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 4.50 Billion |

| Market Size (2029) | USD 6.68 Billion |

| CAGR (2024 - 2029) | 8.22 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Food Packaging Testing Market Analysis

The Food Packaging Testing Market size is estimated at USD 4.5 billion in 2024, and is expected to reach USD 6.68 billion by 2029, growing at a CAGR of 8.22% during the forecast period (2024-2029).

-

The market is mainly driven by its rising awareness for the quality of the food packaging material aiming to deliver food safely to avoid unacceptable change in the composition of the food through migration and keeping the aroma or taste of the food intact. Also, growing concern over the health hazard of chemical migrants from package to food products among consumers and increasingly strict regulation to comply with packaging testing requirements to regulate food safety is another major factor driving the market. However, the high cost of testing by advanced technology is expected to impede the market growth.

-

On the segmentation font by packaging material, the demand for tetra pack has increased significantly in recent years, due to the increased demand for high shelf life food products. Beverage packaging is the dominant application in the packaging testing market, owing to the high consumption of packaged beverage products. Also, plastic holds a major share in the packaging testing material type, driven by the increased use of plastic for food packaging. PET and LLDPE used for food packaging are growing at a faster pace, due to flexible packaging.

Food Packaging Testing Market Trends

This section covers the major market trends shaping the Food Packaging Testing Market according to our research experts:

Increasing demand for advanced packaging material to obtain food safety

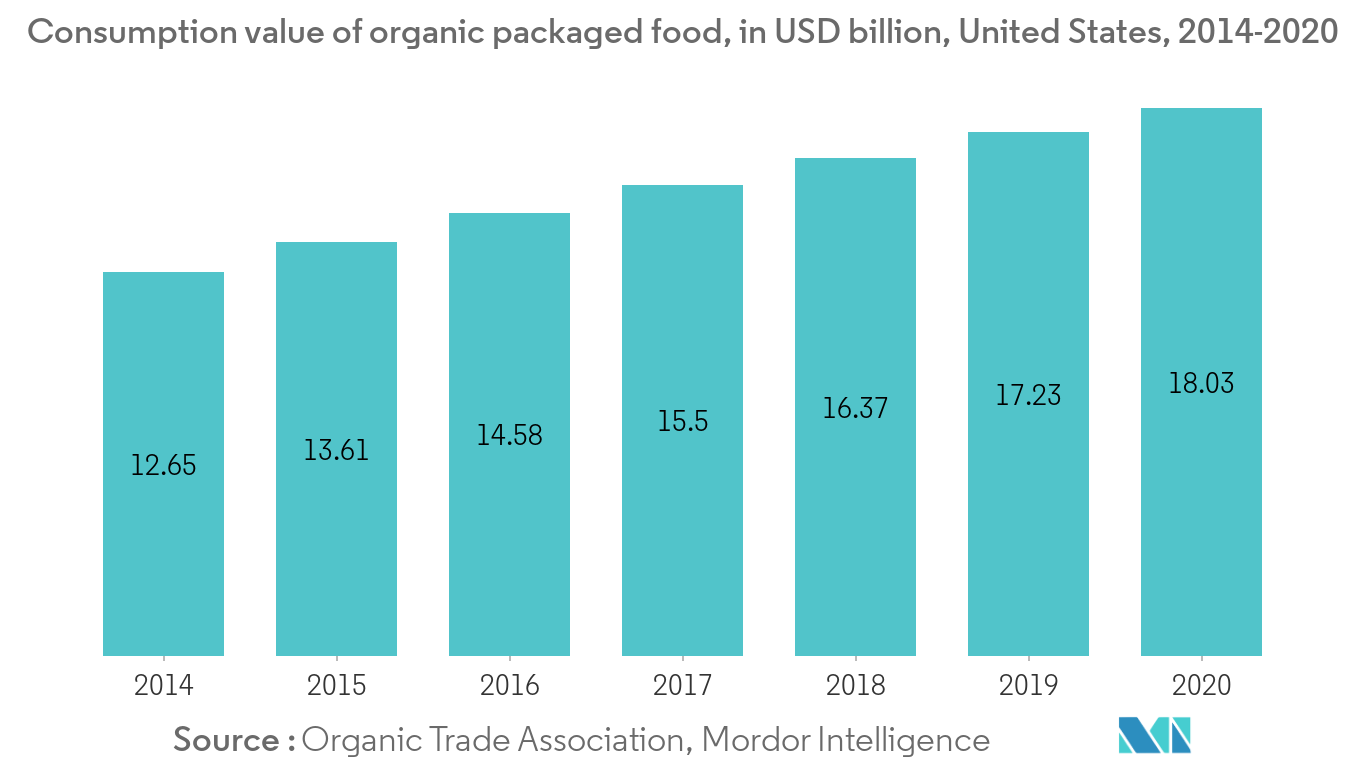

As products reach customers in the packaged form, their safety is an important concern; the presence of any toxic or damaging contaminant could affect the product itself. The presence of contaminants could decrease the quality of the product substantially, which emphasizes the importance of package testing in the market. Therefore, advanced packaging methods, such as intelligent packaging, active, smart packaging, and modified atmosphere packaging, are replacing traditional methods, which deliver no toxic effects on the food quality and are further driving the need to effectively test these packaged goods. According to the Organic Trade Association, sales of organic food package consumption in Latin America Nation, Argentina are forecasted to reach USD 6.5 million in 2020,

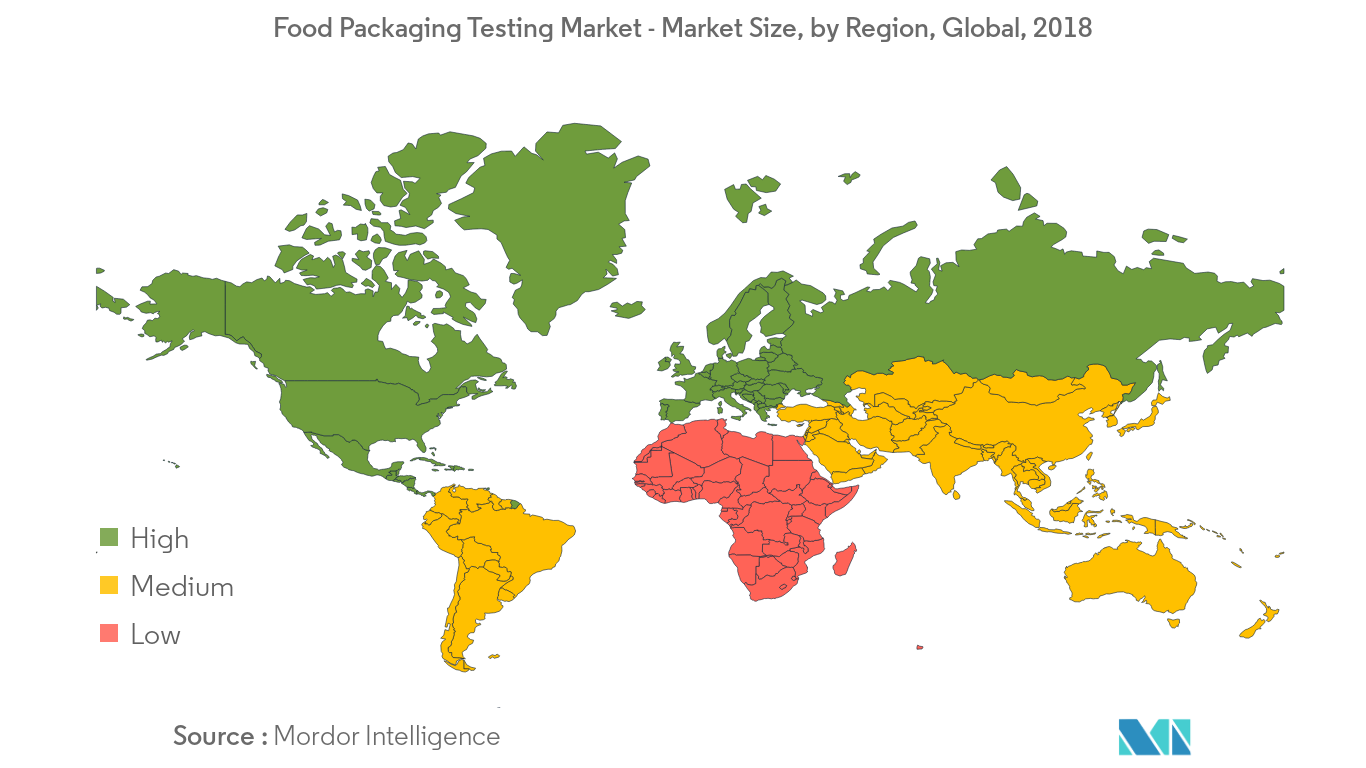

North America and Europe to drive the food packaging testing market

North America has the largest share in the global market of food packaging testing market, which was followed by Europe. Strict safety evaluation of food packaging, which includes toxicology testing, exposure assessment, and risk assessment in EU and North America, is driving the market. A few of the leading international companies dominating these regions include SGS SA, Bureau Veritas Group, Intertek Group plc and Merieux NutriSciences Corporation among others.

Food Packaging Testing Industry Overview

The global market for food packaging testing is fragmented, owing to the presence of large regional and domestic players in different countries. Emphasis is given on the merger, expansion, acquisition, and partnership of the companies along with new product development as strategic approaches adopted by the leading companies to boost their brand presence among consumers. For instance, in April 2019, DDL announced that the Cryopak Testing Center, a 6,000 square foot independent laboratory located at Cryopak's Headquarters in Edison, NJ, has been rebranded as a DDL testing laboratory offering package testing across environmental conditioning, distribution simulation, integrity and strength testing, thermal performance, and shelf-life testing.

Food Packaging Testing Market Leaders

-

SGS SA

-

Bureau Veritas Group

-

Intertek Group plc

-

Merieux NutriSciences Corporation

-

TÜV SÜD South Asia Pvt. Ltd.

*Disclaimer: Major Players sorted in no particular order

Food Packaging Testing Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Drivers

-

4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

-

4.3.1 Threat of New Entrants

-

4.3.2 Bargaining Power of Buyers/Consumers

-

4.3.3 Bargaining Power of Suppliers

-

4.3.4 Threat of Substitute Products

-

4.3.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Testing Type

-

5.1.1 Physical Testing

-

5.1.1.1 Durability Testing

-

5.1.1.2 Heat Resistance Testing

-

5.1.1.3 Water Vapor /Gas Permeability Testing

-

-

5.1.2 Chemical Testing

-

5.1.2.1 Migration Testing

-

5.1.2.2 Extractable Testing

-

5.1.2.3 Leachable Testing

-

5.1.2.4 Others

-

-

-

5.2 By Packaging Material

-

5.2.1 Plastic

-

5.2.2 Glass

-

5.2.3 Metal

-

5.2.4 Paper & Board

-

5.2.5 Layer Packaging

-

-

5.3 Geography

-

5.3.1 North America

-

5.3.1.1 United States

-

5.3.1.2 Canada

-

5.3.1.3 Mexico

-

5.3.1.4 Rest of North America

-

-

5.3.2 Europe

-

5.3.2.1 Spain

-

5.3.2.2 United Kingdom

-

5.3.2.3 Germany

-

5.3.2.4 France

-

5.3.2.5 Italy

-

5.3.2.6 Russia

-

5.3.2.7 Rest of Europe

-

-

5.3.3 Asia Pacific

-

5.3.3.1 China

-

5.3.3.2 Japan

-

5.3.3.3 India

-

5.3.3.4 Australia

-

5.3.3.5 Rest of Asia-Pacific

-

-

5.3.4 South America

-

5.3.4.1 Brazil

-

5.3.4.2 Argentina

-

5.3.4.3 Rest of South America

-

-

5.3.5 Middle East and Africa

-

5.3.5.1 South Africa

-

5.3.5.2 Saudi Arabia

-

5.3.5.3 Rest of Middle East and Africa

-

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Most Active Companies

-

6.2 Most Adopted Strategies

-

6.3 Market Share Analysis

-

6.4 Company Profiles

-

6.4.1 SGS SA

-

6.4.2 Bureau Veritas Group

-

6.4.3 Intertek Group plc

-

6.4.4 Merieux NutriSciences Corporation

-

6.4.5 TUV SUD South Asia Pvt. Ltd.

-

6.4.6 Eurofins Scientific

-

6.4.7 Microbac Laboratories Inc.

-

- *List Not Exhaustive

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Food Packaging Testing Industry Segmentation

Theglobalfood packaging testingmarkethasbeen segmentedbycategoryintophysical and chemical tests. Thephysical testsegment can be further bifurcated intodurability, heat resistance and water vapor/gas permeability tests; and the chemical test is bifurcated into migration, extractable, leachable and other tests.Bypackaging material, the market is segmentedintoplastic, glass, metal, paper & boardandlayer packaging such as Tetrapack.Also, the study provides an analysis of the drinkable yogurtmarket in the emerging and established markets across the globe, including North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

| By Testing Type | ||||||

| ||||||

|

| By Packaging Material | |

| Plastic | |

| Glass | |

| Metal | |

| Paper & Board | |

| Layer Packaging |

| Geography | |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

|

Food Packaging Testing Market Research FAQs

How big is the Food Packaging Testing Market?

The Food Packaging Testing Market size is expected to reach USD 4.50 billion in 2024 and grow at a CAGR of 8.22% to reach USD 6.68 billion by 2029.

What is the current Food Packaging Testing Market size?

In 2024, the Food Packaging Testing Market size is expected to reach USD 4.50 billion.

Who are the key players in Food Packaging Testing Market?

SGS SA, Bureau Veritas Group, Intertek Group plc, Merieux NutriSciences Corporation and TÜV SÜD South Asia Pvt. Ltd. are the major companies operating in the Food Packaging Testing Market.

Which is the fastest growing region in Food Packaging Testing Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Food Packaging Testing Market?

In 2024, the North America accounts for the largest market share in Food Packaging Testing Market.

What years does this Food Packaging Testing Market cover, and what was the market size in 2023?

In 2023, the Food Packaging Testing Market size was estimated at USD 4.16 billion. The report covers the Food Packaging Testing Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Food Packaging Testing Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Food Packaging Testing Industry Report

Statistics for the 2024 Food Packaging Testing market share, size and revenue growth rate, created by ����vlog��ý™ Industry Reports. Food Packaging Testing analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.