Recovery Drink Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.00 % |

| Fastest Growing Market | Europe |

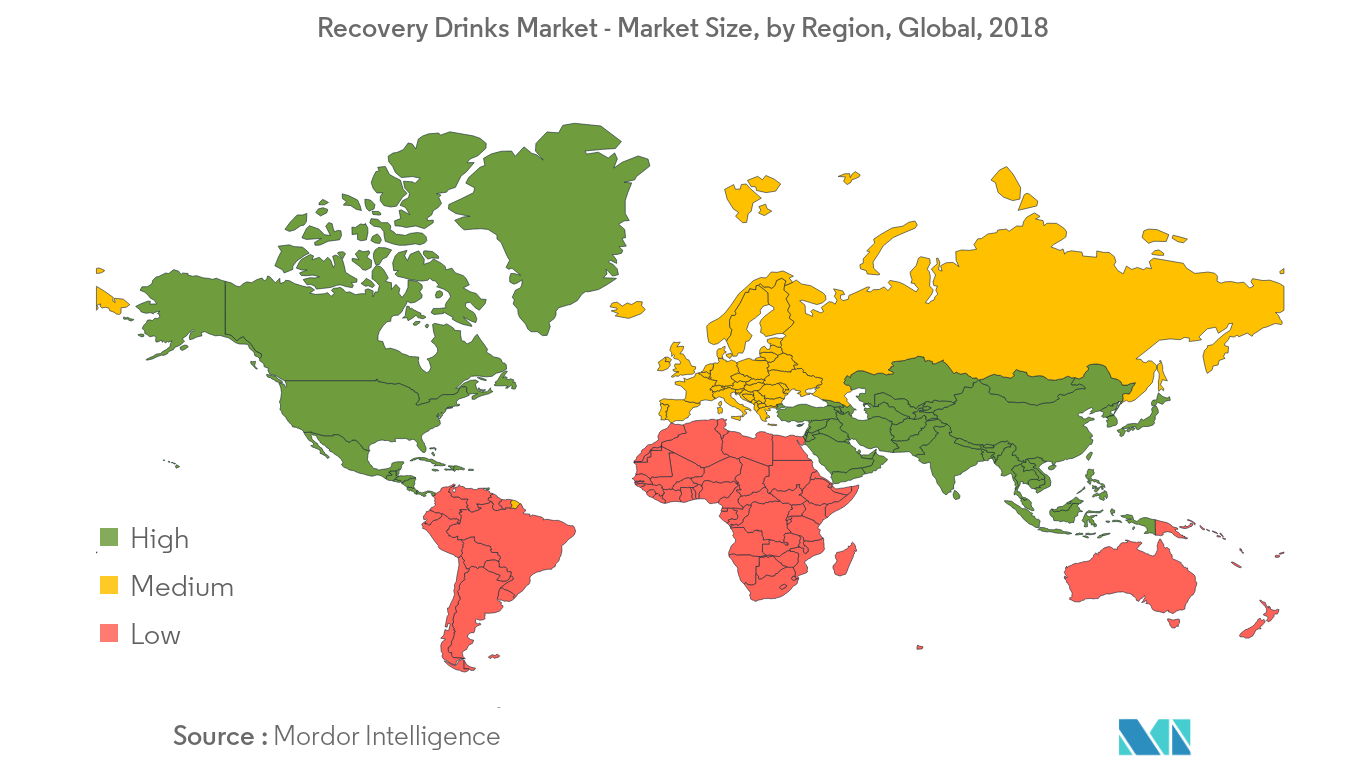

| Largest Market | North America |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Recovery Drink Market Analysis

The global recovery drinks market is growing at a CAGR of 6.0% during the forecast period (2019-2024).

- This segment contains the drinks that are rich in carbohydrates, proteins or electrolytes, generally consumed post a strenuous work out to replenish the dehydrated contents from the body during workouts and its market is majorly driven by the athletes and fitness conscious consumers.

- On a segmentation front by type, powders are leading the market sales due to the advantages it possesses over RTE drinks, having a longer shelf-life than RTE drinks which tend to degrade over time. Among the category of drinks available under-recovery drinks market, isotonic drinks hold the major share over hypertonic and hypotonic drinks owing to its benefits over others and the presence of carbohydrates and high bioavailability characteristics. This is followed by the hypotonic drinks that are expected to grow faster in the forecasted years due to the increasing awareness of keeping the body hydrated among consumers.

- However, factors restraining the growth of the market is the high price of recovery drinks compared to regular beverages, which is attributed to the ingredients used and high production costs.

Recovery Drink Market Trends

This section covers the major market trends shaping the Recovery Drinks Market according to our research experts:

Increased demand of organic recovery drinks

While traditional recovery drinks are still popular, awareness for health consciousness and holistic wellness have led to a shift in the category. The region is witnessed by increasing consumption of organic energy drinks and brands such as Organic Muscle, Vega, Atrium Innovations Inc. (Garden of Life) and many more, developing these beverages with organic and/or natural ingredients that are perceived as a better alternative. Some of the most common ingredients in these drinks are protein plant-based drink, whole food magnesium drink, and electrolyte powder. According to the Organic Trade Association, there is a constant increase in the consumption of organic recovery drinks in Brazil from 2014 to 2020 which shows the increase in demand for organic recovery beverages globally.

Europe is the fastest growing region

Europe is expected to grow the fastest growing region due to the increasing health consciousness among the consumers and disposable income in the emerging markets of Germany, France, Italy, and Spain. Also, increased adoption of western lifestyle has paired the driving factors of the market sales. Product development of recovery drinks such as dairy-based drinks and alcoholic recovery drinks, that appeal to health-conscious consumers have triggered the market growth. For instance, Oatly, a Swedish company launched two recovery drinks- Pineapple/Passion fruit/Spirulina and Apple/Beetroot/Ginger to provide an optimum balance between protein and carbohydrates in 2016.

Recovery Drink Industry Overview

The recovery drinks market is competitive in nature having a large number of domestic and multinational players competing for market share. Emphasis is given on the merger, expansion, acquisition, and partnership of the companies along with new product development as strategic approaches adopted by the leading companies to boost their brand presence among consumers. For instance, Vampt, a Canadian beverage company, had launched a low calorie, an electrolyte-infused beer called “Lean Machine”. Also, Sufferfest Beer Company in 2019, launched an electrolyte recovery beer “FKT” Pale Ale, brewed using vitamin C-rich blackcurrants and infused with 65 mg of salt per serving. Also, Oatly will be expanding its business into mainland China, with the opening of an office in Shanghai and sales through more than 2,200 Chinese coffee shops and retailers in the coming months of 2019.

Recovery Drink Market Leaders

-

PepsiCo Inc.

-

Glanbia PLC

-

Abbott Nutrition

-

Rockstar, Inc.

-

Sufferfest Beer Company

*Disclaimer: Major Players sorted in no particular order

Recovery Drink Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Drivers

-

4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

-

4.3.1 Threat of New Entrants

-

4.3.2 Bargaining Power of Buyers/Consumers

-

4.3.3 Bargaining Power of Suppliers

-

4.3.4 Threat of Substitute Products

-

4.3.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Type

-

5.1.1 RTD

-

5.1.2 Powder

-

-

5.2 By Category

-

5.2.1 Isotonic

-

5.2.2 Hypotonic

-

5.2.3 Hypertonic

-

-

5.3 By Distribution Channel

-

5.3.1 Supermarkets/Hypermarkets

-

5.3.2 Sports Nutrition chain

-

5.3.3 Convenience Stores

-

5.3.4 Online Retail Stores

-

5.3.5 Other Distribution Channels

-

-

5.4 Geography

-

5.4.1 North America

-

5.4.1.1 United States

-

5.4.1.2 Canada

-

5.4.1.3 Mexico

-

5.4.1.4 Rest of North America

-

-

5.4.2 Europe

-

5.4.2.1 Spain

-

5.4.2.2 United Kingdom

-

5.4.2.3 Germany

-

5.4.2.4 France

-

5.4.2.5 Italy

-

5.4.2.6 Russia

-

5.4.2.7 Rest of Europe

-

-

5.4.3 Asia Pacific

-

5.4.3.1 China

-

5.4.3.2 Japan

-

5.4.3.3 India

-

5.4.3.4 Australia

-

5.4.3.5 Rest of Asia-Pacific

-

-

5.4.4 South America

-

5.4.4.1 Brazil

-

5.4.4.2 Argentina

-

5.4.4.3 Rest of South America

-

-

5.4.5 Middle East and Africa

-

5.4.5.1 South Africa

-

5.4.5.2 United Arab Emirates

-

5.4.5.3 Rest of Middle East and Africa

-

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Most Active Companies

-

6.2 Most Adopted Strategies

-

6.3 Market Share Analysis

-

6.4 Company Profiles

-

6.4.1 PepsiCo Inc.

-

6.4.2 Glanbia plc

-

6.4.3 Abbott Nutrition

-

6.4.4 Rockstar, Inc.

-

6.4.5 Sufferfest Beer Company

-

6.4.6 Mountain Fuel

-

6.4.7 Oatly

-

6.4.8 Fluid Sports Nutrition

-

- *List Not Exhaustive

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Recovery Drink Industry Segmentation

Global recovery drinks market has been segmented by product types (which includes RTD and Powder), by category (which includes isotonic, hypotonic and hypertonic drinks), by distribution channel (which includes Supermarkets/ Hypermarkets, Sports Nutrition chain, Convenience Stores, Online Retail Stores, and others) and by geography (which includes North America, Europe, Asia-Pacific, South America and Middle East and Africa).

| By Type | |

| RTD | |

| Powder |

| By Category | |

| Isotonic | |

| Hypotonic | |

| Hypertonic |

| By Distribution Channel | |

| Supermarkets/Hypermarkets | |

| Sports Nutrition chain | |

| Convenience Stores | |

| Online Retail Stores | |

| Other Distribution Channels |

| Geography | |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

|

Recovery Drink Market Research FAQs

What is the current Recovery Drinks Market size?

The Recovery Drinks Market is projected to register a CAGR of 6% during the forecast period (2024-2029)

Who are the key players in Recovery Drinks Market?

PepsiCo Inc., Glanbia PLC, Abbott Nutrition, Rockstar, Inc. and Sufferfest Beer Company are the major companies operating in the Recovery Drinks Market.

Which is the fastest growing region in Recovery Drinks Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Recovery Drinks Market?

In 2024, the North America accounts for the largest market share in Recovery Drinks Market.

What years does this Recovery Drinks Market cover?

The report covers the Recovery Drinks Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Recovery Drinks Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Recovery Drink Industry Report

Statistics for the 2024 Recovery Drink market share, size and revenue growth rate, created by ����vlog��ý™ Industry Reports. Recovery Drink analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.