Molecular Breeding Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 8.23 Billion |

| Market Size (2029) | USD 18.91 Billion |

| CAGR (2024 - 2029) | 18.10 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Molecular Breeding Market Analysis

The Molecular Breeding Market size is estimated at USD 8.23 billion in 2024, and is expected to reach USD 18.91 billion by 2029, growing at a CAGR of 18.10% during the forecast period (2024-2029).

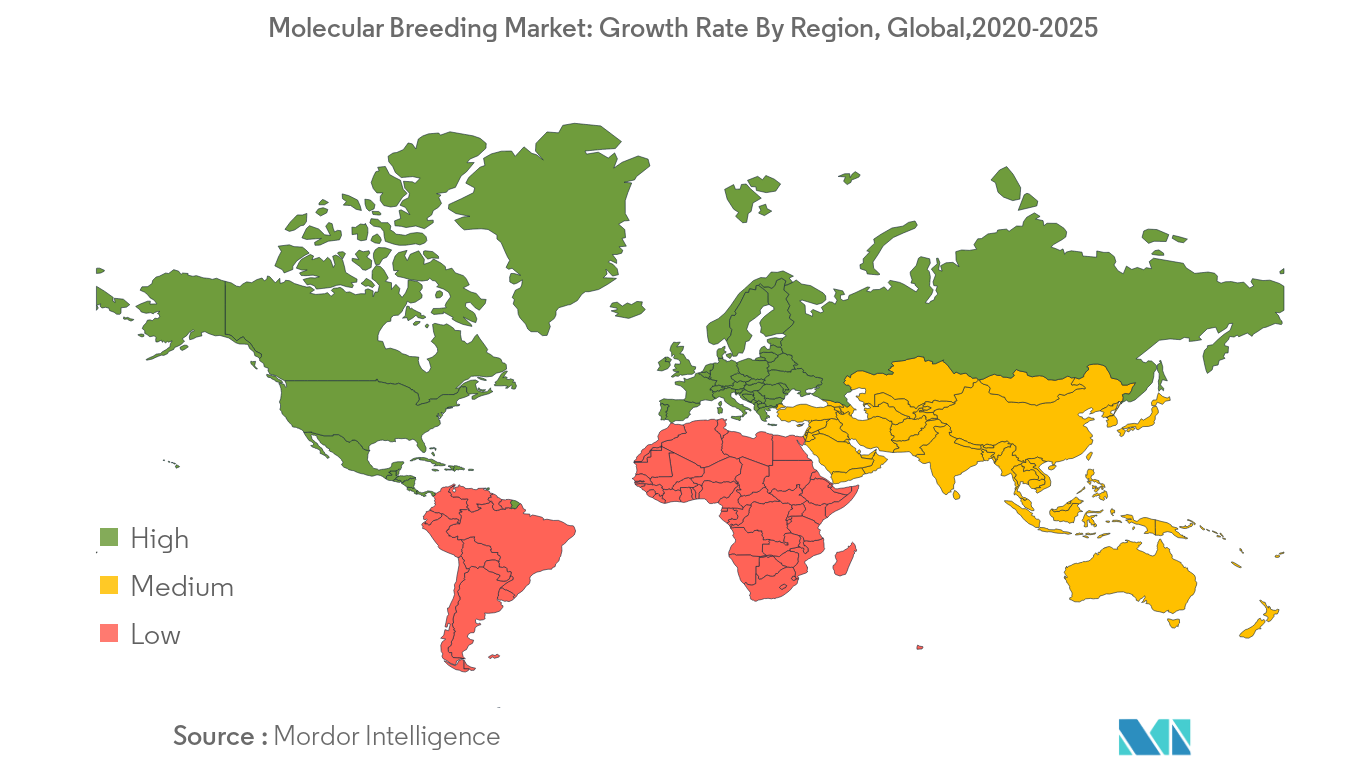

The process of developing new crop varieties almost takes around 20- 25 years but this time limit can be shortened to almost 7-8 years by using biotechnology. Tools like marker-assisted selection (MAS) make it easier and faster for the scientist to select plant traits with more productive results. Molecular breeding technology is in the nascent stage. Netherland and UK witnessed 100% adoption of molecular breeding techniques for new crop variety. Major players in seed companies have been adopting these technologies for improvement in seed varieties. The decline of prices in the genetic and research departments leads to the improvement of the market. Funds flow from private as well as public sectors towards plant breeding and genetic research such as genomic selection in field and vegetable crops and application of MAS will gear up the market in the future. The molecular breeding market is projected to grow highest in the Asia-Pacific region during the forecast period.

Molecular Breeding Market Trends

This section covers the major market trends shaping the Molecular Breeding Market according to our research experts:

Increase in production of Corn exponentially

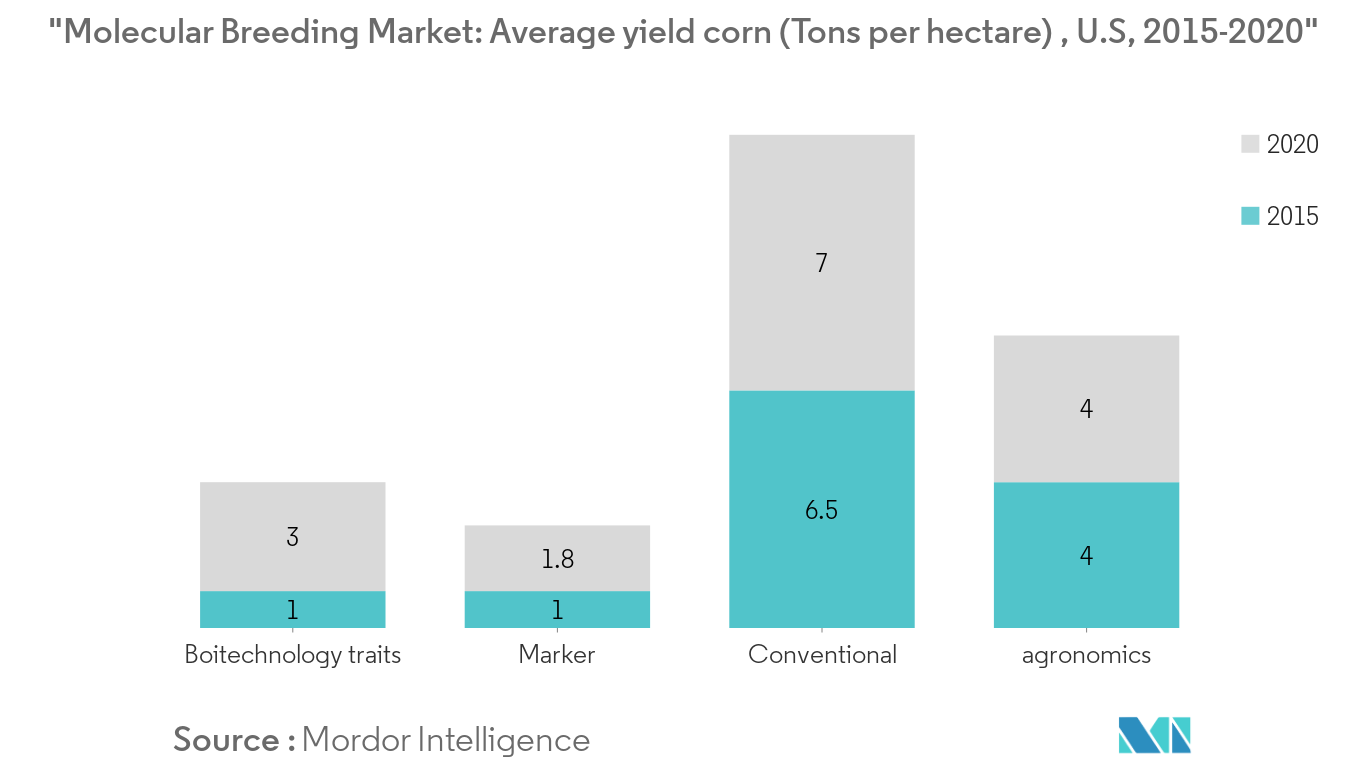

Global demand for food production and consumption increasing at a rapid pace. U.S. average corn yield has increased from 1.6tonnes/hectare in the first half of the 20th century to approximately 9.5tonnes/ha. The dramatic yield improvement is due to the use of hybrid corn, synthetic fertilizers, and the adoption of new farm practices that drives the molecular breeding market. Introduction of molecular breeding traits and development of new breeding technology using DNA based markers created a new and innovative market for molecular breeding. For instance, Over the next two decades, biotechnology traits and marker-assisted breeding have the potential to double the corn yields in the U.S.

North America account for largest share

North America accounted for the largest share in the molecular breeding market in 2017, followed by Europe due to high yield in the production of wheat and maize as awareness among the farmers about the benefits of molecular breeding are increasing which will create a scope in the future market. The presence of major companies in US and Canada followed by Europe has resulted in increasing adoption of the molecular breeding market. The Molecular breeding market in the Asia-Pacific region is projected to grow with highest rate due to increasing investment from the key players in countries such as India, China, and Thailand.

Molecular Breeding Industry Overview

The molecular breeding market is highly fragmented and major players have used many strategies such as pricing analysis of the product, new product development, acquisition and mergers, expansion, the partnership to make a footprint in the market. Major players like Syngenta using advance modified genotyping platforms from "Thermo Fisher Scientific" to provide necessary data for the breeding pipeline to quickly select the new varieties with much better yield potential.

Molecular Breeding Market Leaders

-

illumina

-

LGC Limited

-

Thermo Fisher Scientific

-

SGS

-

Eurofins

*Disclaimer: Major Players sorted in no particular order

Molecular Breeding Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Overview

-

4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

-

4.4 Market Restraints

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

-

4.5.1 Threat of New Entrants

-

4.5.2 Bargaining Power of Buyers/Consumers

-

4.5.3 Bargaining Power of Suppliers

-

4.5.4 Threat of Substitute Products

-

4.5.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 On basis of application

-

5.1.1 Plant

-

5.1.2 Livestock

-

-

5.2 On basis of marker

-

5.2.1 Simple sequence repeat

-

5.2.2 Single nucleotide polymorphism

-

5.2.3 Expressed sequence tags

-

5.2.4 Others

-

-

5.3 On basis of molecular breeding process

-

5.3.1 Marker assisted selection

-

5.3.2 QTL Mapping

-

5.3.3 Marker assisted back crossing

-

-

5.4 Geography

-

5.4.1 North America

-

5.4.1.1 United States

-

5.4.1.2 Canada

-

5.4.1.3 Mexico

-

5.4.1.4 Rest of North America

-

-

5.4.2 Europe

-

5.4.2.1 Germany

-

5.4.2.2 United kingdom

-

5.4.2.3 France

-

5.4.2.4 Russia

-

5.4.2.5 Spain

-

5.4.2.6 Rest of Europe

-

-

5.4.3 Asia Pacific

-

5.4.3.1 China

-

5.4.3.2 Japan

-

5.4.3.3 India

-

5.4.3.4 South Korea

-

5.4.3.5 Rest of Asia-Pacific

-

-

5.4.4 Rest of World

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Most Adopted Strategies

-

6.2 Market Share Analysis

-

6.3 Company Profiles

-

6.3.1 Illumina

-

6.3.2 LGC Limited

-

6.3.3 Thermo Fisher Scientific

-

6.3.4 SGS

-

6.3.5 LemnaTec

-

6.3.6 Charles River

-

6.3.7 DanBred

-

6.3.8 Intertek

-

6.3.9 Eurofins

-

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Molecular Breeding Industry Segmentation

Marker-assisted selection (MAS) was estimated to dominate the molecular breeding market in the forecasting period. The report covers an extensive study of segments and factors driving the growth of the commercial molecular breeding market. An in-depth analysis of the futures market and trend was exclusively measured in this report. Factors driving region-wise analysis are also covered with great observations.The report includes market shares of the Molecular Breeding market for global, Europe, North America, Asia Pacific, South America and the Middle East & Africa.

| On basis of application | |

| Plant | |

| Livestock |

| On basis of marker | |

| Simple sequence repeat | |

| Single nucleotide polymorphism | |

| Expressed sequence tags | |

| Others |

| On basis of molecular breeding process | |

| Marker assisted selection | |

| QTL Mapping | |

| Marker assisted back crossing |

| Geography | ||||||||

| ||||||||

| ||||||||

| ||||||||

| Rest of World |

Molecular Breeding Market Research FAQs

How big is the Molecular Breeding Market?

The Molecular Breeding Market size is expected to reach USD 8.23 billion in 2024 and grow at a CAGR of 18.10% to reach USD 18.91 billion by 2029.

What is the current Molecular Breeding Market size?

In 2024, the Molecular Breeding Market size is expected to reach USD 8.23 billion.

Who are the key players in Molecular Breeding Market?

illumina, LGC Limited, Thermo Fisher Scientific, SGS and Eurofins are the major companies operating in the Molecular Breeding Market.

Which is the fastest growing region in Molecular Breeding Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Molecular Breeding Market?

In 2024, the North America accounts for the largest market share in Molecular Breeding Market.

What years does this Molecular Breeding Market cover, and what was the market size in 2023?

In 2023, the Molecular Breeding Market size was estimated at USD 6.97 billion. The report covers the Molecular Breeding Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Molecular Breeding Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Molecular Breeding Industry Report

Statistics for the 2024 Molecular Breeding market share, size and revenue growth rate, created by ����vlog��ý™ Industry Reports. Molecular Breeding analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.